Citigroup (C) reported an increase in fourth-quarter earnings, which also exceeded market expectations, mainly reflecting the bank’s cost-cutting initiatives. Revenues, meanwhile, declined and fell short of expectations hurt by a sharp fall in the fixed income securities business. Shares of the financial services giant dropped about 1% following the announcement Monday.

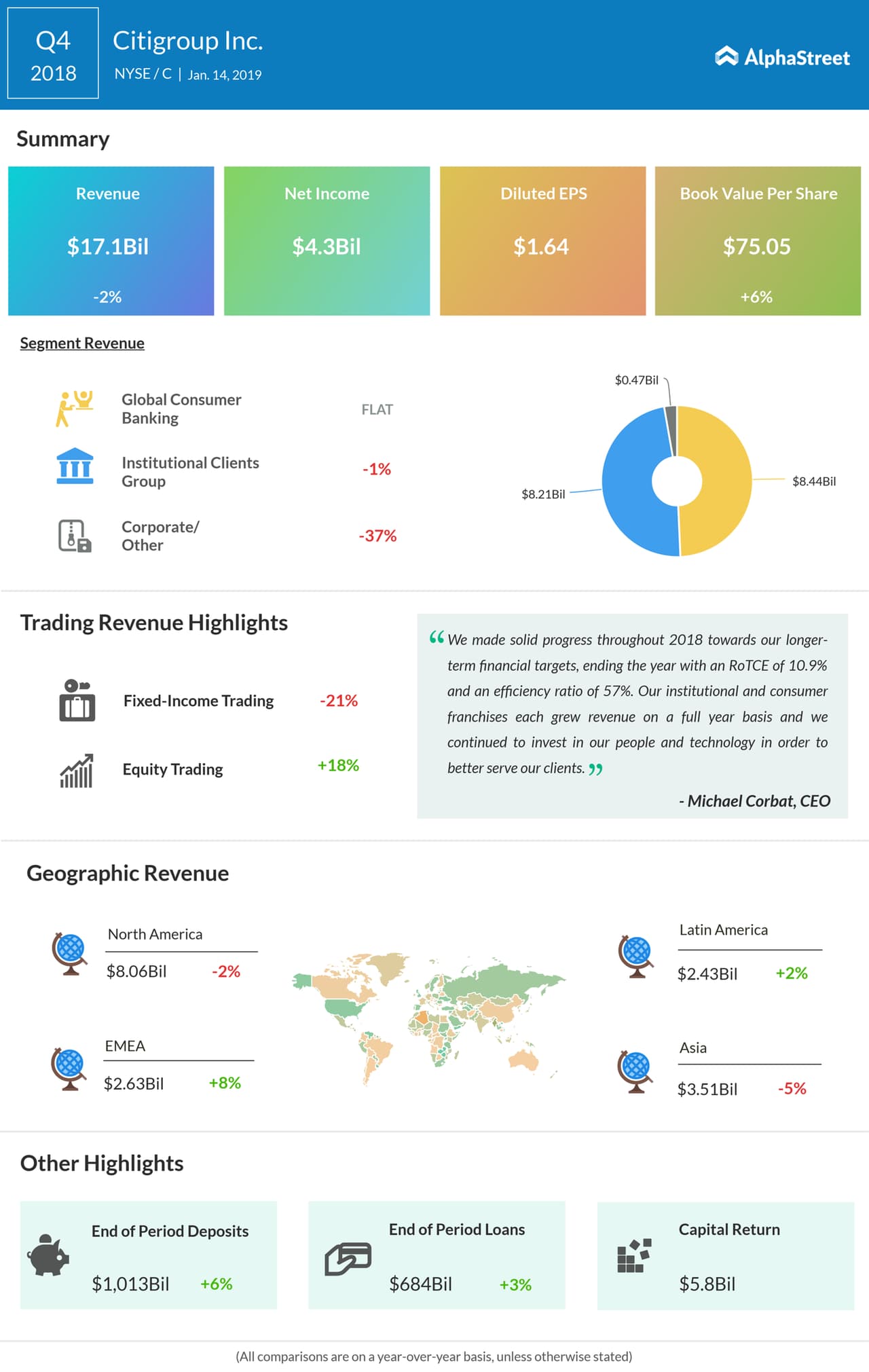

During the three-month period, adjusted profit rose to $4.2 billion or $1.61 per share from $3.7 billion or $1.28 per share a year earlier. Analysts were looking for slower growth. Earnings benefitted from a 4% decline in expenses to $9.89 billion. Unadjusted net income was $4.3 billion or $1.64 per share, compared to a loss $18.9 billion or $7.38 per share in the fourth quarter of 2017, which included one-time items related to the tax revision.

Revenues, meanwhile, dropped 2% year-over-year to $17.1 billion in the fourth quarter and came in below analysts’ forecast. The top line was negatively impacted by the continuing slump in trading revenue, marked by a 21% decline in the fixed-income segment that more than offset an 18% growth in the equity business.

The top line was negatively impacted by the continuing slump in trading revenue, marked by a sharp decline in the fixed-income segment

While the Institutional Clients Group as a whole registered a 1% dip in revenues, Global Consumer Banking remained flat. A wind-down of legacy assets in the corporate section also added to the downturn. Citi ended 2018 with a Return on Average Tangible Common Equity of 10.9% and an efficiency ratio of 57%.

The bank had total loans of $684 billion at the end of the quarter, higher by 3% compared to last year, and deposits of $1 trillion, up 6%. The management returned $5.8 billion of capital to common shareholders, which includes the repurchase of about 74 million shares.

“A volatile fourth quarter impacted some of our market sensitive businesses, particularly Fixed Income. For 2019, we remain committed to delivering a 12% RoTCE and continuing to improve our operating efficiency during the year,” said Citi CEO Michael Corbat.

The last twelve months were relatively tough for Citigroup shares, which suffered a 30% fall during that period, underperforming sector. The stock dropped modestly in the premarket trading Monday, paring a part of the gains seen since the beginning of the year.