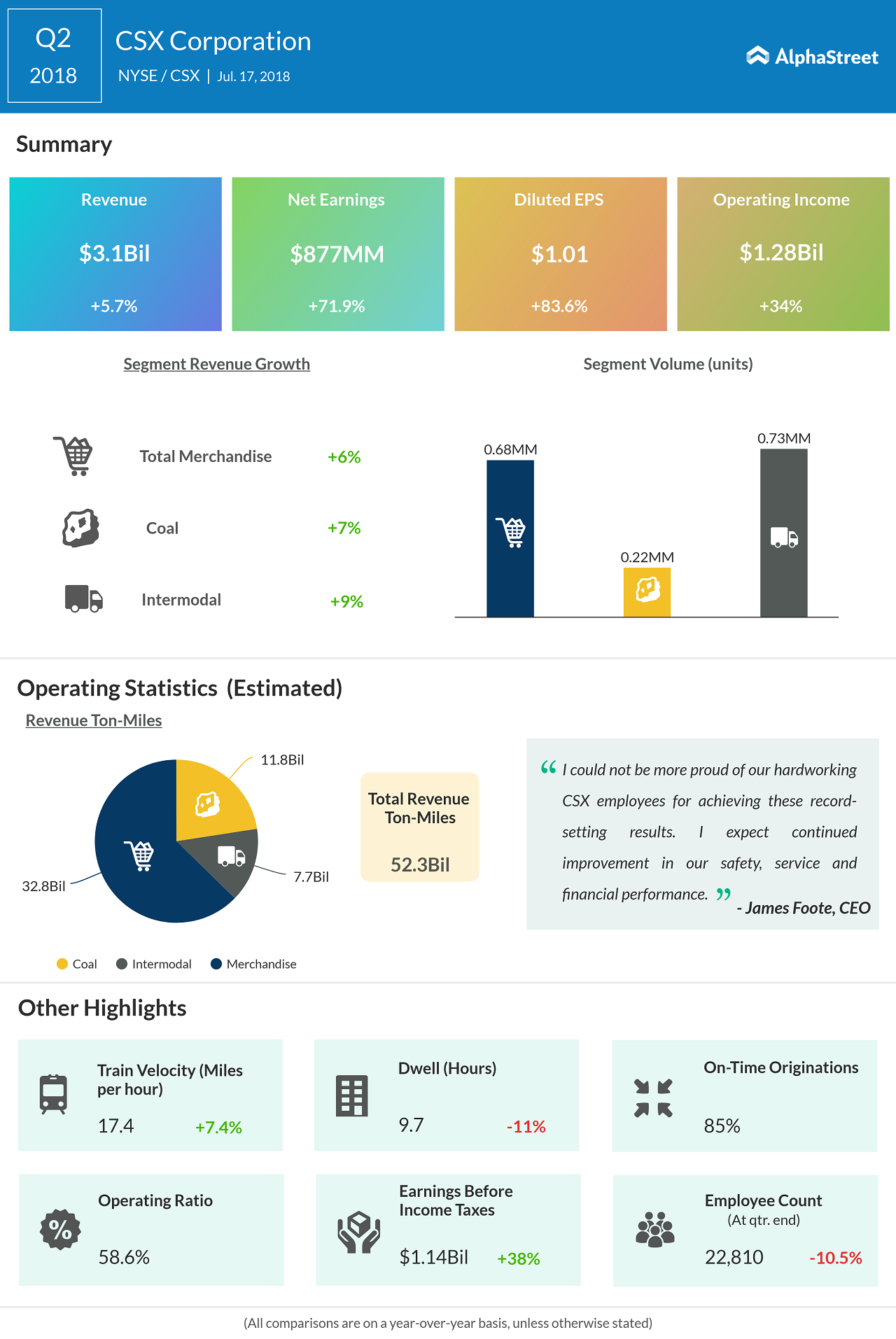

CSX Corp (CSX) on Tuesday posted earnings of $1.01 per share on revenue of $3.10 billion, beating estimates. 25 analysts predicted earnings of $0.84 per share. The Street estimate for revenue this quarter was $2.95 billion, 0.68% higher than $2.93 billion a year ago. Shares rose as high as $64.58 before the market close.

Last year same quarter, the Conrail parent posted profits of $0.55 a share and $0.64 per share on an adjusted basis.

For the second quarter, CSX Corp saw revenue rise 6%, while expenses shrink 8%. When prior-year restructuring charges are excluded, expenses inched down 2%.

Total volumes were 2% higher at 1.65 million units, with Total Merchandise volumes almost flat at 0.69 million units. Coal inched 7% higher to 222 thousand units, while Intermodal volumes were 2% higher at 735 thousand units. Domestic Intermodal volume fell slightly due to tightening truck capacity adding to the rationalization of low-density lanes in late 2017. Internationally, however, volumes inched up due to new customers and strong performance with existing customers.

CEO James M. Foote, lauding the employees, said, “While we remain in the early stages of the transformation I am more confident this exceptional team can deliver on our longer-term outlook.”

In the second quarter, operating income soared 34% to $1.28 billion. The increases in fuel recovery, price rises across all markets and volume growth in most markets, helped CSX.

From an operational perspective, total revenue ton-miles rose 7% to 52.3 billion while train velocity and car dwell improved seven and eleven percent respectively.