Zscaler Inc. (NASDAQ: ZS) reported a wider loss in the first quarter of 2020 due to higher costs and expenses despite a 48% jump in the top line. The results exceeded analysts’ expectations. Further, the cloud security company lifted its guidance for the full year 2020.

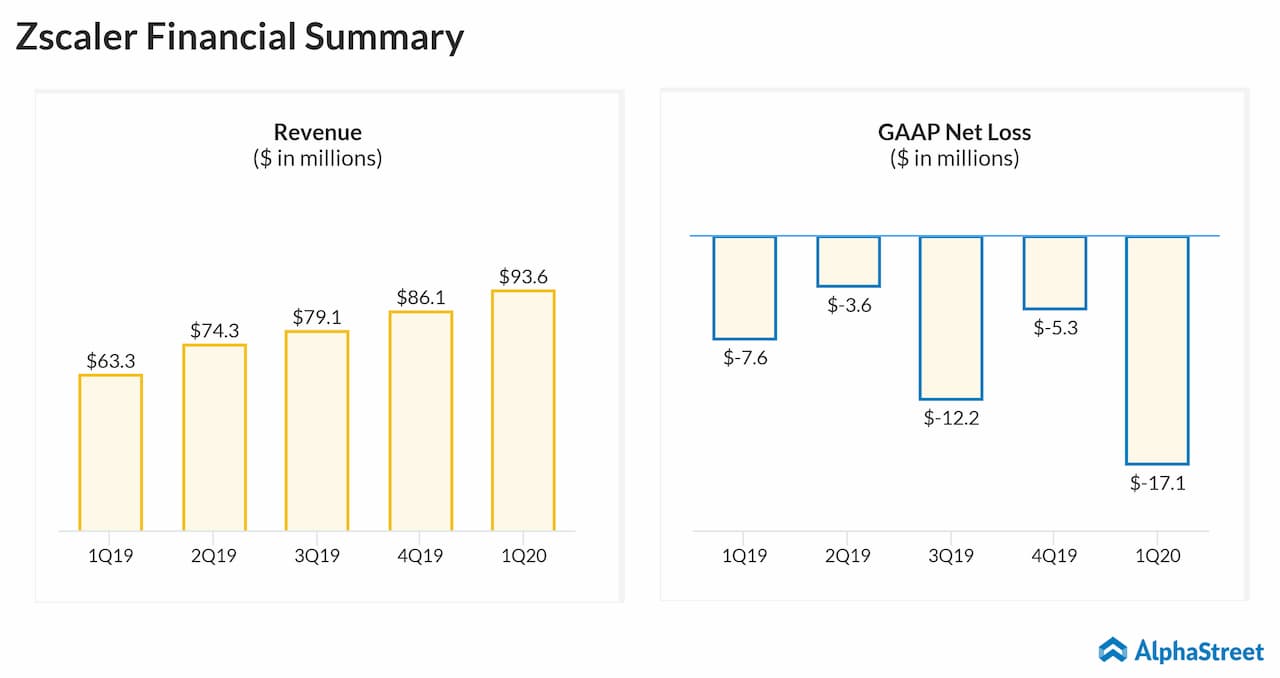

Net loss was $17.1 million or $0.13 per share compared to a loss of $7.6 million or $0.06 per share in the previous year quarter. Adjusted earnings soared by 50% to $0.03 per share.

Total revenue jumped by 48% to $93.6 million. The top line benefited from a 37% growth in calculated billings. Deferred revenue climbed by 49% year-over-year to $245.9 million.

Looking ahead into the second quarter of 2020, the company expects total revenue in the range of $97-100 million and adjusted earnings of about $0.03 per share.

For the full year 2020, the company lifted its total revenue outlook to the range of $405-413 million from the previous range of $395-405 million. Adjusted earnings guidance is narrowed to the range of $0.13-0.15 per share from the prior range of $0.12-0.15 per share. Calculated billings forecast is raised to the range of $500-510 million from the earlier range of $490-500 million.

The company said it continues to significantly invest in its business for pursuing a large market opportunity. Zscaler sees enterprises increasingly transforming their network and security to realize the benefits of the cloud as it scales all elements of its go-to-market strategy.

The company continues to tap on the opportunity of expanding its customer base both in the US and worldwide as this could aid in turning itself profitable. Also, Zscaler will continue to invest in R&D for new services and additional addressable market segments expansion.

13 Comments

Comments are closed.

Arie Baisch

[…]here are some links to web-sites that we link to because we feel they are worth visiting[…]

Chirurgie esthétique Tunisie

[…]Here is a superb Weblog You may Locate Fascinating that we Encourage You[…]

National Chi Nan University

[…]although websites we backlink to beneath are considerably not associated to ours, we really feel they may be essentially worth a go as a result of, so possess a look[…]

ما هو افضل تخصص في ادارة الاعمال

[…]Sites of interest we have a link to[…]

Welcome Note for faculty of pharmacy

[…]always a significant fan of linking to bloggers that I appreciate but really don’t get a lot of link enjoy from[…]

fue

[…]Here are some of the web sites we advise for our visitors[…]

قسم علم الأحياء الدقيقة والمناعة

[…]Here is a superb Weblog You may Discover Interesting that we Encourage You[…]

Lecture Halls

[…]here are some links to web sites that we link to since we consider they’re really worth visiting[…]

الحياة الطلابية بكلية الهندسة

[…]Every the moment in a whilst we select blogs that we study. Listed beneath are the most recent web sites that we pick […]

contact Vice Deans Faculty of Engineering and tecnology

[…]Wonderful story, reckoned we could combine a couple of unrelated data, nevertheless really really worth taking a look, whoa did a single study about Mid East has got more problerms as well […]

Faculty Handbook

[…]The details talked about inside the post are a few of the most beneficial offered […]

smart systems

[…]Wonderful story, reckoned we could combine some unrelated information, nonetheless actually worth taking a appear, whoa did one discover about Mid East has got much more problerms as well […]

برنامج إدارة الأعمال في مصر

[…]one of our visitors a short while ago encouraged the following website[…]